pet health insurance monthly cost explained for budget-minded owners

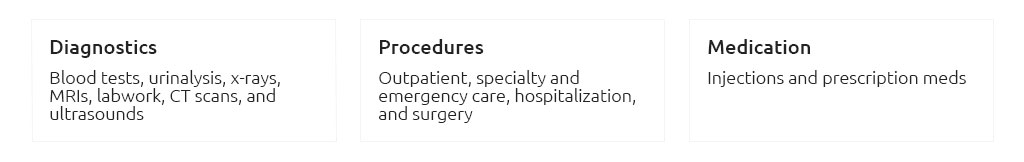

What actually drives the monthly price

I track the bill like any other household line item. A few levers move it up or down, and they're not mysterious once you map them.

- Pet profile: breed, age, and ZIP code change risk, which changes price.

- Coverage type: accident-only is cheaper; accident + illness costs more but covers more.

- Annual limit: higher limits raise premiums; lower limits trim them.

- Reimbursement %: 70% costs less than 80% or 90%.

- Deductible: higher deductible lowers the monthly; lower deductible does the opposite.

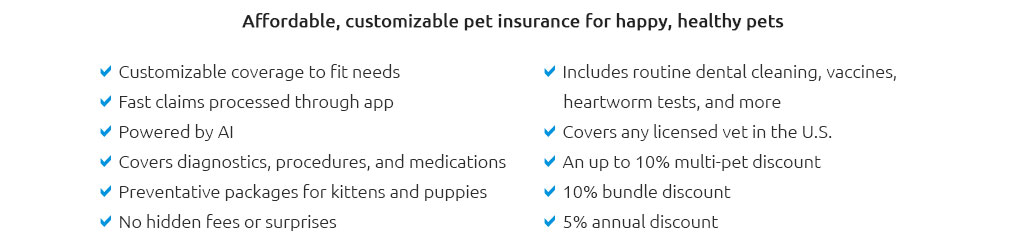

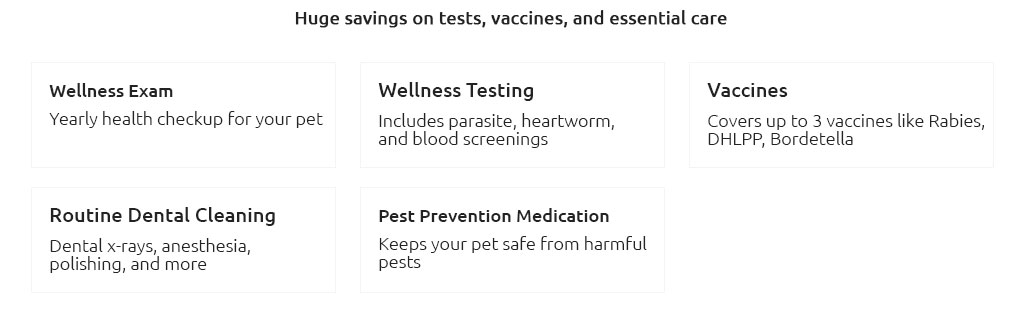

- Add-ons: wellness/dental/rehab riders add a few to many dollars monthly.

- Exclusions & waiting periods: broader exclusions can make prices look "good" (skeptical aside: good for whom?).

Ballpark ranges to sanity-check

Cats: roughly $15 - $35 for accident-only; $25 - $60 for comprehensive. Dogs: about $25 - $50 for accident-only; $35 - $95 for comprehensive. Seniors run higher. If you see $9 for a senior bulldog, pause - it likely pairs a sky-high deductible with tight exclusions.

How the levers change your bill

- Deductible: moving from $250 to $500 can shave several dollars per month; above $1,000, the monthly looks nice but the first big vet visit won't.

- Reimbursement: 70% vs 90% can swing premiums 10 - 25%; 80% is a common middle.

- Annual limit: $5k vs unlimited might change cost by double digits monthly; pick a cap that covers your local "worst month," not an apocalypse.

- Exam fees & copays: some cover them, others don't. Small line items add up over a year.

Quick evaluation steps

- List likely care this year: routine, one injury/illness, and an outlier. Put rough prices next to each.

- Run a simple total: premium x 12 + expected out-of-pocket under a sample plan vs paying cash.

- Check the exclusions page for hereditary issues, dental injury vs disease, behavioral care, and prescription food.

- Confirm flexibility: can you adjust deductible/limits at renewal, add/remove riders, or get multi-pet discounts?

- Read claims turnaround and whether direct pay to vets is available; speed matters on tight months.

A small real-world moment

Bean, my terrier, limped after a park sprint; x-rays and meds were $410. With a $28/month policy, $250 deductible, 80% reimbursement, I would've seen about $128 back. Not a windfall, but it softened the hit while keeping monthly spend under $30 - enough to make next month's budget feel normal again.

Flexibility over perfection

I prefer plans that let me tweak the deductible and limits at renewal. Life changes; budgets change. If a plan won't bend, I keep looking.

Where your money goes

Pricing blends expected claims, admin, and vet inflation. It's not just "profit" - though margins exist. The question is whether the risk-transfer fits your cash flow and your pet's likely needs.

Use-case snapshots

- Young indoor cat: accident-only around $15 - $25 can be fine if you can cash-flow minor illness; comprehensive near $30 - $45 adds peace for urinary or GI surprises.

- Large-breed puppy: $45 - $85 for broad coverage is common; I'd consider a higher deductible to keep monthly sane and protect against big orthopedic bills.

- Senior rescue dog: $70 - $120 isn't unusual and exclusions grow. Sometimes a mid-tier plan plus a small "vet fund" beats chasing ultra-low premiums. Yes, a jar labeled "vet fund" is less exciting than a glossy brochure.

Ways to lower monthly cost without gutting protection

- Pick a higher (not extreme) deductible - often the best savings per dollar of pain.

- Choose a realistic annual limit; $5k covers many bad days.

- Skip wellness if you already plan and price routine care.

- Ask about multi-pet or pay-in-full discounts if cash flow allows.

- Keep claims straightforward and timely; some carriers reward clean histories.

Red flags that quietly raise costs later

- Per-condition or per-incident deductibles instead of annual ones.

- Benefit schedules with fixed payouts far below real vet prices.

- Age-based copays that jump sharply every renewal.

- Pre-auth hoops that make reimbursable care hard to access.

Bottom line

Target a pet health insurance monthly cost you barely notice and coverage you'll appreciate on rough days. Evaluate the whole year, not just the premium, and favor plans that let you adjust as your budget or your pet's needs change.